The neobank for Francophone Africa

We make access to credit easier in West Africa through innovative solutions: reverse factoring and deferred payments (B2B and B2C BNPL), supported by intelligent risk models.

Custom solutions for various industries

Collect your insurance invoices within 48 business hours

Finco pre-finances your invoices within days to preserve your cash flow, so you can stop chasing payments.

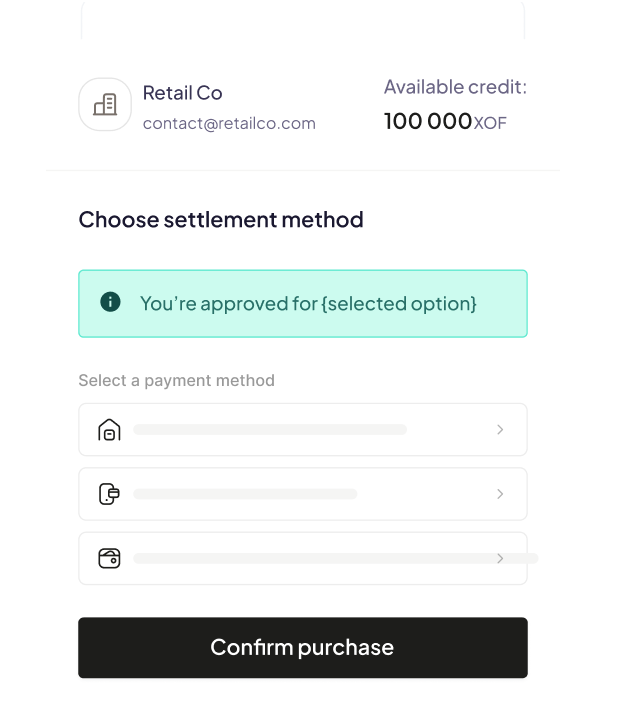

The easier it is to pay, the bigger the order

30 to 60-day deferred payment, no collateral required, to sustainably boost business growth with our BNPL solution.

Turn outstanding invoices into immediate working capital

Finco advances working capital against purchase orders, allowing you to expand your inventory and territory without bank paperwork.

Offer affordable vehicle financing to drive more sales

Enable customers to purchase cars and motorcycles with flexible payment plans while you receive full payment upfront.

Bridge payment gaps between projects with invoice financing

Integrate Finco credit in-store or online to increase conversion and basket size while we take on the repayment risk.

Access funds while waiting for public sector payments

Get paid in 48 hours against approved government contracts instead of waiting months for bureaucratic payment cycles.

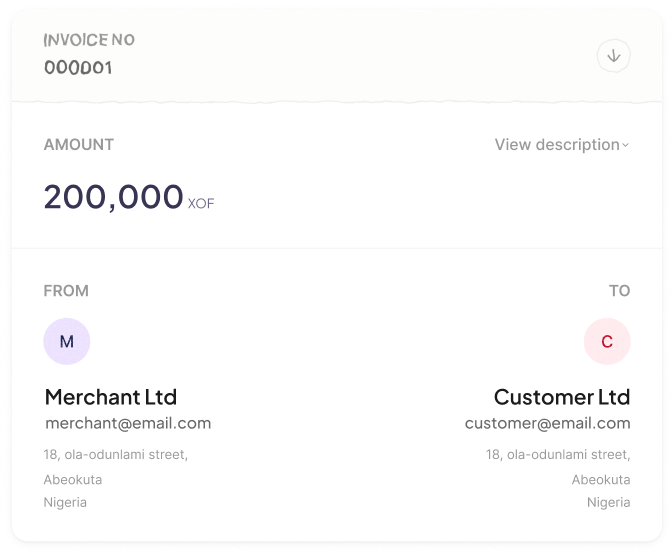

How it works in three simple steps

Our streamlined process makes financing easy and efficient. Follow these simple steps to get the funds you need.

Sign up and verification

Quick account setup with identity verification to get started with our platform.

Submit your finance application in a minute

Submit your financing application with required documents through our streamlined process.

Get paid

Receive funds quickly once your application is approved and processed.

Your personal data is protected under Benin's Digital Code (Law No. 2017-20) and registered with APDP (Autorité de Protection des Données à caractère Personnel), ensuring full compliance with local data protection standards.